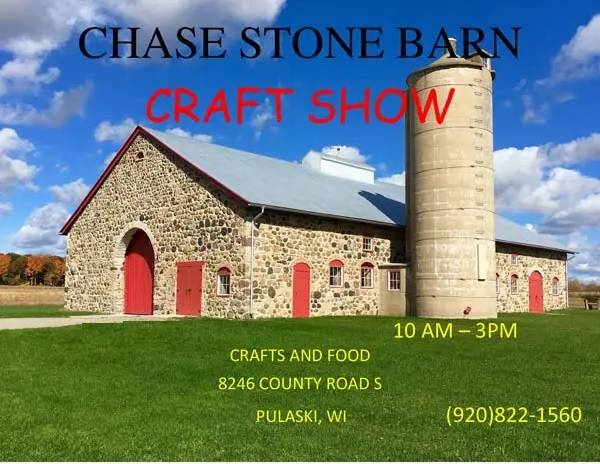

When: September 14, 2025

Time: 10am-3pm

Download the Vendor Rental form below

Vendor Tax Requirements –Stone Barn Craft Sale

The State of Wisconsin requires all Stone Barn Craft Sale vendors to comply with state tax regulations:

- If your total annual sales are less than $2,000, you must complete Form S-240, Part C (Vendor Information Form).

- If your total annual sales are $2,000 or more, you are required to complete and submit Form BTR-101 (Application for Wisconsin Business Tax Registration) to the Department of Revenue. https://www.revenue.wi.gov/TaxForms2017through2019/btr-101.pdf